operations

Tight operations allow small business to be nimble. Highly efficient and responsive businesses can pivot toward markets that will allow them to capture larger profits.

Working on your business is very different then working in your business. Most business owners have a particular technical skill that they sell to a customer. It’s precisely this skill that tends to get buried under the growing demands of a business that has an increasing number of complexities. Billing customers, developing and maintaining an internet presence, and managing staff are just a few of the demands that owners may find distracting them from their true skills, producing the work that brought them to business in the first place.

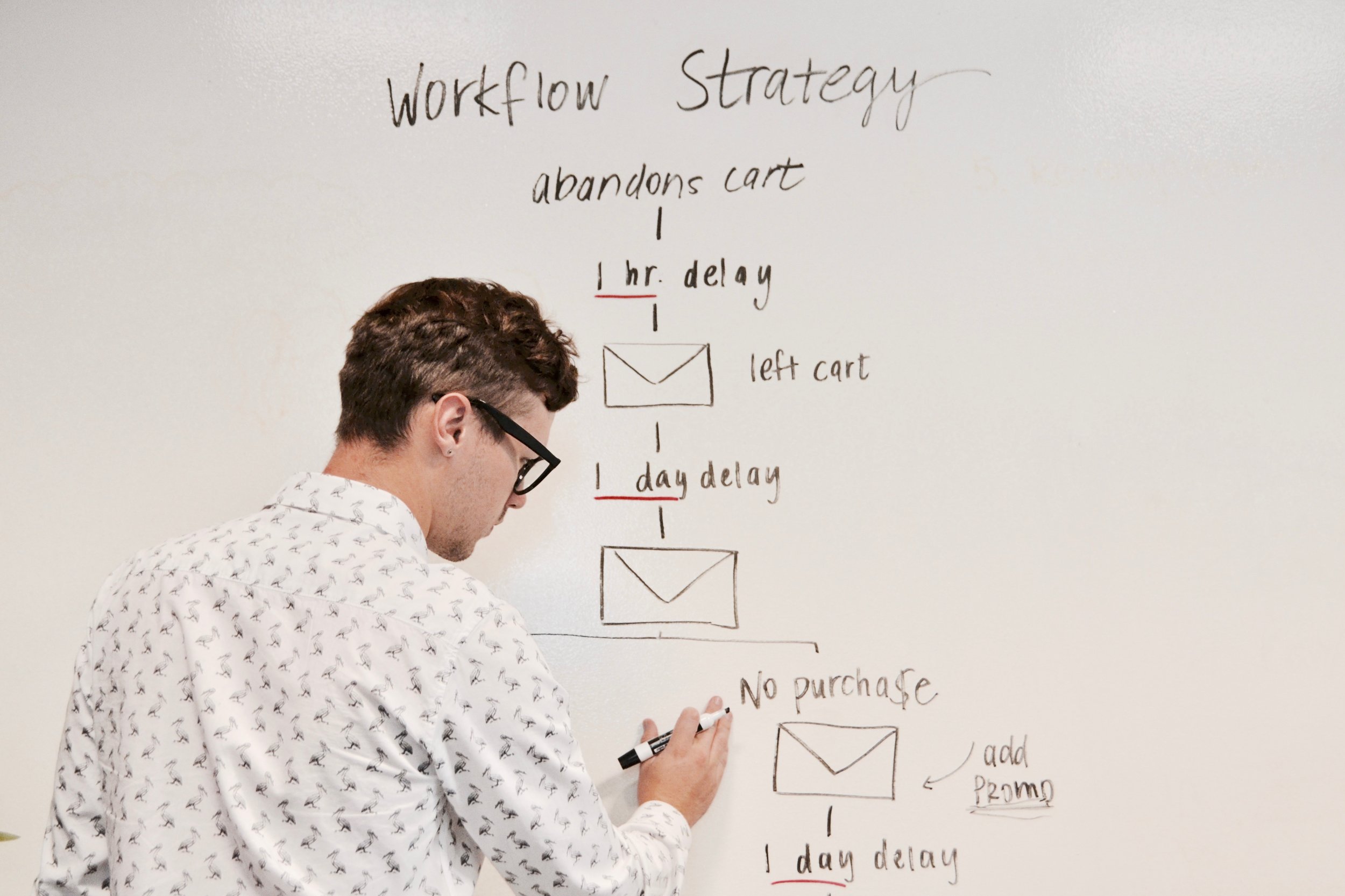

We have the ability to quickly understanding the many disparate systems and operations a business currently uses. This allows us to rapidly determine workflow improvements and strategy adjustments that lead to results and improved financial performance.

What you do on a day-to-day basis can easily consume all of your business time. Daily operations, leadership development, bookkeeping, monthly data analysis, scheduling of meetings, meeting format, monthly/quarterly budget reviews, and annual budgeting.

focus areas

Workflow analysis

Bookkeeping

Billables/Collections/AR/AP duties

Staffing A-Z

Annual budgeting

Monthly Report-out and Performance Analysis

Business cycle development

Leadership development

Customer service excellence

Developing online presence

Establishing online transaction functionality